Practical Training Accountant Programme

The accountancy sector is one of the most lucrative job sectors due to high rate of employability. Practical Accountancy Training is a job determined training program, proper for all candidates seeking a profession in accounting. Applicants will be guided online under the supervision of adequate Accountants. We have thoughtfully structured this course to give candidates the practical skills to make accounts from inventories up to the Final Accounts, including Bank Reconciliation, VAT return, and Management Accounts.Useful Accountancy Training program could be complete of using Tally Prime, QuickBooks, and Excel.

However, simply having some academic qualifications may not help you much to build your dream career in accounting. Increasingly employers prefer candidates with more practical skills and who can be productive from day 1. Moreover, if you are intending to offer accountancy services through a practice, it is vital to have the knowledge of real-life processes and accounting software operations involved.

Our practical accounting courses are developed by tutors who are expert in the industry to ensure you get the necessary practical skills required to fast track your career in accounting.

Practical Accountancy Training is released online under the surveillance of our modified accountants using original company files. Practical Accounting Training helps students gain information and exposure to real-life scenarios which is not enough from a university level education. Accounting training helps to sharpen your accounting skills and makes you more familiar with the accounting industry. It increases your chance of getting accounting internships and jobs. For a fresh accounting graduate, the theory makes you knowledgeable but unless you know how to implement the knowledge in a true working environment, you are not ready to become a successful accountant. One of the best ways to stand out from the crowd and show you have proper dedication in the accounting field is to gain practical accounting training.

In colleges and Universities, you read different theories and concepts of accounting which helps to increase your theoretical knowledge. All the examples and cases completed are developed in a perfect scenario and you are just required to give correct answers to the questions. But when you go to the real working environment and get exposed to real-life scenarios the situation is completely different. The theoretical knowledge alone is not enough for you to become a successful accountant.

Let’s take an example of how one learns to swim. Just reading books on how to swim does not make you able to swim. You need to get proper advice from an expert, and you should dive into the water to learn to swim. Similarly, in the accounting field both theoretical and practical knowledge should go hand in hand.

Objectives of the Practical Training

Monthly Management Accounts: In Management Accounts Training, you will determine how to prepare management accounts with the use of real-time models. After the education program, you will receive a training certificate which will raise your opportunities for getting a job. Management accounts allowed to enable high-ups in business to make conclusions based on the financial status of the company.

The primary knowledge of management accounting helps in generating the most relevant internal financial information systems. This course demonstrates how you can interpret financial statements to make the proper decisions in the day-to-day activities of an industry, which will assist you in adding value to the organisation.

Management accounts are statements that contain data that is helpful for the management’s current needs. The monthly management accounts training gives a quick overview of how a set of management accounts can produce and what needs in its production. Management accounts training supports in taking the right decisions.

Final Accounts Preparation: The Final Accounts training curriculum unites all the training and classes at Future Connect and delivers a high-end practical knowledge of the complete accounting sequence. You will be rising with Bookkeeping and VAT Return at the grounding of this course. After having precise Bookkeeping skills in different industries, the learners move on to an intermediate level of accountancy and study to close the books for the year-end. At this staging, the primary Trial Balances calculated, and attendees allowed to attend the academic classes focussing on CIS, Control Accounts, Advanced Excel, and FRSSE.

The Final accounts practice done on Sage Accounts Production Advanced software; they could also practice other software like XERO and QuickBooks with MS Excel. The trainee can now create a complete company file that involves the calculation of Corporation Tax.

This program is proper for both people new to accountancy and with industry experience in the accounting area and wants to intensify their skills for expert-level accounting. CPD Certified professionals will teach you. They will encourage you throughout the entire training process with a hands-on functional experience that will put you in a launchpad your career in this fast-paced accounting background.

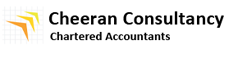

1. Increases Employment Opportunities

Companies today prefer candidates with practical experience as it takes a lot of time and effort for the companies to train the person for the job.

With the increasing competition in the accounting job market, employers have the option to make a choice between candidates with experience and candidates who do not have any training and experience. In this case, any employer would choose a candidate who has practical experience in accounting.

2. Build a Stronger Resume

As per the statistics, on average every corporate job opening attracts 250 resumes. But only 4 to 6 of these people will be called for the job interview and only 1 will be offered a job. To make your resume stand out among others, you can tailor your resume to the specific accounting job by including the accounting training and experience you have relevant to the job.

3. Enhance analytical skills

Good analytical skill is one of the important characteristics of successful accountants. Analytical skill is very useful to solve problems, make a business decision and provide recommendations to clients and management. All this can be gained from practical training in accounting. The probability of hiring candidates with analytical skills is more as this helps them to excel in their job.

4. Better Understanding of theoretical knowledge

Practical Accounting Training programs help to better understand the theoretical knowledge that students have gained from their college or University degrees. For instance, you read about journal entries, ledgers, trial balance and financial reports. But you may find it difficult to apply the theoretical knowledge in practical scenarios.

5. Provides clarity to career option

Job Ready Accounting training helps to sharpen accounting skills and provides exposure to various parts of accounting like accounts receivable/ payable, payroll, financial reporting, and many more. This exposure will help the graduates to understand how the accounting process works and provide a clearer idea of which part of accounting they want to pursue in their accounting career

Career Path for Accountants

The Practical Accountancy training is suitable for candidates from all different background of knowledge.It helps students gain information and exposure to real-life scenarios which is not enough from a university level education. Accounting training helps to sharpen your accounting skills and makes you more familiar with the accounting industry. It increases your chance of getting accounting internships and jobs.

If you really desire to have a good accounting career it is very important to be up to date with the industry and get yourself equipped with all the required accounting training. Do not hesitate to invest in yourself for your career development. The little investment you make today in your training will give you maximum return in the future!

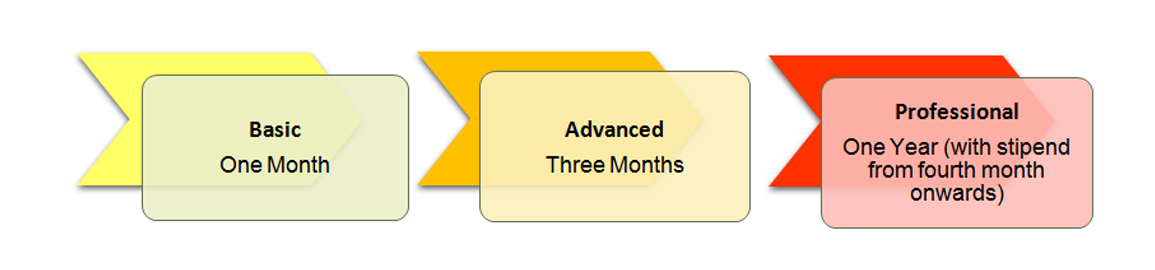

PTA Program Courses of Study

The program is organised in 10 modules. The curriculum progresses in content complexity, as you move through the 10 modules.

“Our Professionals are also discussing the key areas of Accounting Standards like IFRS (International Financial Reporting Standards), GAAP (Generally Accepted Accounting Principles), IAS (International Accounting Standards) etc.”

“Accounting is the language of business.” — Warren Buffett

Course Batches

Why Choose Cheeran Consultancy for PTA?

i. Work with the best: The Cheeran Consultancy only hire the best and brightest, so you will be working with some of the most talented and motivated individuals in the industry every day. You will also collaborate with individuals from different departments throughout the business, both locally and internationally, meaning you will be exposed to a lot of new areas fast and will learn something new every day. This makes sometimes very long workdays (we’ll get to that later) much more enjoyable.

ii. Amazing Clients: In your first year as an Executive, you will be exposed to processes and controls with some of the largest and prestigious businesses in Middle East and Asia Pacific. The simple breadth and quality of the clients at Cheeran Consultancy is unrivalled, so no matter where you go your experience will be completely unique.

iii. Flexibility: Outside of busy season and when you are not engaged with a client, you will have a large amount of flexibility to work. This means outside commitments, like family responsibilities, can be met much of the year. The most important thing is that when there is work to do, it gets done and to a high degree of quality.

iV. Responsibility: As early as your second year, you will become directly responsible for overseeing junior staff, meaning that every day you will have one (or more) people that you are managing to a degree. This will involve managing and supervising their workload, helping them with their career development and reporting to your manager on their progress. Very few careers offer direct managerial experience this early, and you will be able to take this experience into your next role, whether you remain with the firm or move on.

V. Growth Opportunities: A huge pro of working with Cheeran Consultancy firm is the significant development and growth opportunities that will be available to you. Not only will you receive hands-on training from top professionals and be able to lead your own audit/tax teams early in your career, but you will also have various opportunities to move within the business into different specialisms or departments, such as Corporate Finance, Data Analytics or Forensic Accounting. Additionally, you will have a structured career path that will allow you to achieve regular promotions, take part in international secondments or move to different offices around the world.

Vi. Job Security: Job security has especially been brought into sharp focus during the year 2020 due to the ongoing Covid-19 pandemic, and many people in accounting and finance teams in businesses across the country have found themselves unemployed through no fault of their own. The Cheeran Consultancy has remained relatively unscathed, and business has continued to grow, even in the event of an economic downturn or financial crisis. In most cases, a position within these businesses can be considered a secure one.

Vii. A huge CV boost: Working for Cheeran Consultancy will allow you to get the foot in the door at almost any accounting firm or financial institution you want, if you decided to move on. Experience at Cheeran Consultancy is a seal of approval and will garner a high level of respect over the course of your career.

Training Class Arrangements

Contact Details

Cheeran Consultancy

GSM: +91 85907 49227, +91 62388 87642

No.57/4400, Tower Line, Cochin 20, India

E-mail: info@cheerangroup.com